Small Business Insurance

Small Business Insurance / for individuals

Youi Small Business Insurance is better in 3 ways.

Simpler

You can arrange it all with one phone call. Whether you want to get on-site, on the road or just get on with business, we make the process easier.

Sharper

We give you the basics so you know you’re covered if a third party sues you for property damage, personal injury or advertising liability. Plus, we offer options you can add on if you want to – like cover for Business items like your tools or protection for stock in trade.

Sorted

Whether you’re a painter, hairdresser or sell pastries at the markets, our specialist team could help you sort out your small business insurance faster.

Your business and the way you run it is unique. That’s why, at Youi, we don’t make assumptions. Instead, we’ll take the time to listen, to find out more about the work you do and see you as an individual. That way, we can provide insurance options that suit. For Small Business Insurance that values you for who you are, get in touch.

Business Property Damage

This option can be added to cover your business contents or stock in trade.

Public & Product Liability

Coverage for certain legal liability situations, such as personal injury claims, where your business is liable to pay compensation to a third party.

Money

Option to add additional cover for your business's money.

Portable Business Items

Option to add additional cover for your tools of trade.

Glass

Option to add additional cover for loss or damage to your internal and external glass at the business premises.

Flexible Limits

Choose from $5,000,000, $10,000,000 or $20,000,000 limits of Public and Product liability.

Do you need Small Business Insurance?

Here are some Public and Product liability examples of if and when your Small Business Insurance would come in handy.

Plumber

You run a small plumbing business and when one of your employees was completing some hot work on a client's home, a spark went unnoticed and ended up causing a small fire, setting the client's bathroom on fire. Your business is responsible for the property damage, but luckily, your Youi Small Business Insurance covers the costs.

Painter

You have a painting business, you have set up correctly ready to spray paint a house, during the job unexpected wind carries the paint spray and covers a client or member of the publics parked car. Your business is responsible for the third party property damage to the car/s and since you have your Small Business Insurance with Youi, it’s covered.

Electrician

One of your electricians did a job a few months ago at a customer's home. Unfortunately, due to some work that the electrician carried out, the meter box has caught fire and your business is responsible for property damage to the customer's home. As a Youi Small Business Insurance customer, your responsibility to pay damages to the customer is covered.

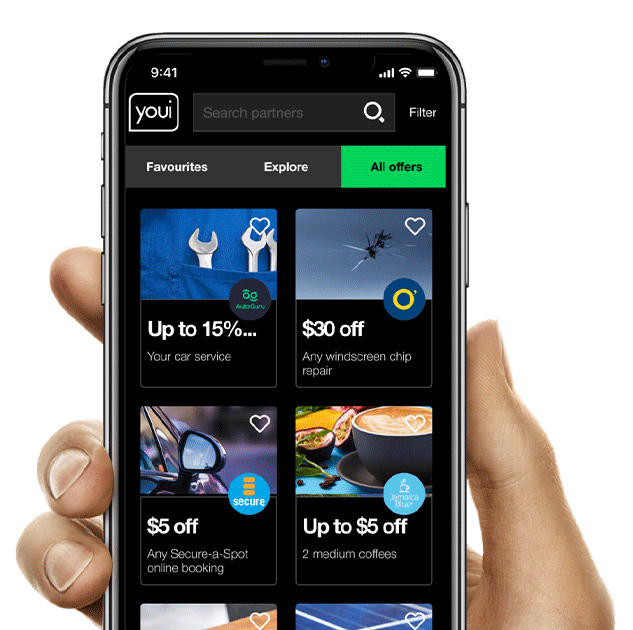

Insurance that rewards you.

Okay, so you’ve got great value insurance with Youi. Now, get great value on some of the other things in your life with YouiRewards. Awesome deals on some of Australia’s best brands that could help you save on your car, home and more. Your insurance is for individuals like you, so your rewards should be too. See what you can save today.

- Big name brands.

- Savings on your car, home and more.

- Offers to suit you.

Meet some of the team behind our Small Business Insurance, and find out what factors could determine the cost of your insurance.

FAQs

You’ve worked hard building your business, so our Small Business insurance will work hard to help protect it.

Youi’s Small Business insurance automatically includes legal liability cover for situations where your business is required to pay compensation to a third party, such as for personal injury or property damage claims.

For example, imagine you own an electrical business, and one of your electricians did a job a few months ago at a customer's home. Unfortunately, due to the work the electrician carried out, the meter box caught fire and caused damage to the customer’s property. In this case, your business may be held liable for the damage, and Youi’s Small Business insurance would generally provide cover for this.

Youi’s Small Business Insurance also automatically includes cover for associated legal costs, and for new quotes or renewing policies from 4 September 2021, it also includes coverage for advertising liability for incidents that occur in connection with advertising a business.

If you want extra protection, you can also choose from our range of optional covers. Our Business Items option provides cover for things like your tools of trade or portable computer equipment, and our Business Property Damage option covers items like your stock in trade and business contents. We also offer Money cover, and if you rent the commercial premises you run your business from, cover for glass.

No one knows your business needs like you, that’s why we’ve included automatic cover for the basics, and let you decide the rest.

Our Small Business Insurance product automatically includes coverage for Public and Products Liability, and based on your business needs, you can also choose from our other optional covers. Our Business Items option provides cover for things like your tools of trade or portable business equipment, and our Business Property Damage covers items like your stock in trade or business contents.

We can also offer cover for your money, and if you rent a commercial premises to run your business from, cover for glass. To help you decide what you need, you can read the Product Disclosure Statement and Policy wording for full details.

It takes a lot of work to build your own business, so let us help you protect it.

Youi’s Small Business insurance automatically includes legal liability cover for situations where your business is required to pay compensation for personal injury or property damage claims. It also automatically includes coverage for associated legal costs, and for new quotes or renewing policies from 4 September 2021, we’ve included automatic advertising liability cover for incidents that occur in connection with advertising a business.

You can also choose from our optional covers based on your business needs, like our Business Items or Business Property Damage covers.

Our Business Items option provides cover for things like your tools of trade or portable business equipment, and our Business Property Damage covers items like your stock in trade or business contents. If you rent a commercial premises to run your business from, you also have the option of glass cover.

It’s good to remember too, that we offer car insurance for business vehicles that might better suit your business needs.

There are a few key themes that will determine how much your Public and Product Liability insurance will cost. These include:

- The nature of your business

- The turnover of your business

- The number of employees and whether you use sub-contractors

- The amount of insurance cover your business needs

- The location of your business

We’ve put together a handy snapshot of what our current Public and Product Liability insurance customers pay in premiums – with the average cost just $69 per month.

From our analysis, we have found that around 40% of our Public and Product Liability insurance customers pay less than $50 per month; while around 45% pay around $51-100 per month for their Public and Product Liability insurance.

At Youi, we provide a simpler and sharper approach to helping you get your Public and Product Liability insurance sorted.

Disclaimer: Average business liability premium for new policies sold between and including 1st Dec 2020 – 31st May 2021.