Fees, commissions and membership

Maximise your profits with our transparent, flexible and competitive membership options

Fair and flexible membership options for every brokerage

Our founders started out as brokers and were determined to develop an aggregation model that is fair and provides real value. That's why we're proud to offer our brokers a fair and flexible fee structure. We offer two membership plans to suit different business types and you're free to switch between plans easily, twice a year, with 30 days' notice.

The freedom to do it your way

No lock-in contracts

We don't restrict you with handcuff agreements or lock-in contracts and you can leave at any time without penalty. And if you have your own credit license, you can do business with our lender panel and still keep up relationships with other lenders.

It's better for you, and it's better for us—because you're not locked in to fixed-term contracts, we're constantly pushing ourselves to deliver better, more innovative products and services so we can continually prove our worth to our members.

Keep your trail book

You've worked hard for your commissions, and you deserve to be rewarded. When you partner with us you'll own your trail book. Enjoy accurate and on-time commissions for the life of your membership and if you choose to leave us, you'll take your trail book with you.

Join Connective todayJoin the Connective community today

Start your journey with Connective today and see why we're the first choice for over 22% of Australia's leading mortgage brokers.

Join Connective Get in touchOur membership options

Connective Maximiser

The best choice for broking businesses who are confident of their volumes and settling around $1 million+ per month.

Join with MaximiserConnective Variable

The best choice for brokers with fluctuating volumes.

Join with Variable

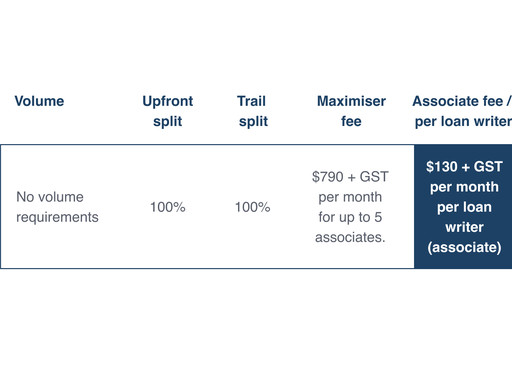

Connective Maximiser

Keep 100% of your up-front commission, and 100% of the trail.

On a Maximiser plan, you'll pay $790 + GST per partner group (brokerage) each month, plus an additional $130 + GST for each loan writer in your business.

For a business operating under its own Australian Credit License, that has three administrative staff and two loan writers, the Connective membership fee would be: $790 brokerage fee + ($130 x 2 loan writers) = $1,050 + GST each month.

You'll get access to our full range of Connective products and services and have the full support of the Connective business behind you.

Connective Variable

On a Variable plan, you’ll pay a small commitment of just $130 + GST per month for each loan writer in your business. So whether you’re working by yourself, or in a small team, you’ll see strong return on your membership.

Under the Variable plan, your commissions are paid on a sliding scale, meaning that the higher your loans are, the more commission you'll retain. So as your business grows, so will your rewards.

Plus, you'll get access to our full range of Connective products and services and have the full support of the Connective business and teams behind you.

Affordable credit representative fees

If you don't have your own credit licence or wish to operate under ours, you can become a credit representative under Connective's licence. Our credit representative fees are $190 + GST per month for each loan writer in your business, on top of whichever Connective membership model you have.

Join Connective todayGet our free information pack

Find out more about the Connective difference and start your journey to becoming a Connective member.

Personalised support to grow your business

“Connective's competitive fee structure allows me to attract the best brokers to my business and it is easy to use for all parties. I am particularly impressed with the synergy our businesses have achieved. I have been able to substantially grow my business with Connective's assistance.”

Dean LaFrenais, Blue Print Homes

Join the Connective community today

Start your journey with Connective today and see why we're Australia's leading aggregator.